Property owners opposed to paying additional fees on their utility bills could delay Black Diamond’s plans to annex 821.44 acres of Foothills County land.

Diana Hocking and Erna Ference disputed Black Diamond’s annexation proposal, which would require annexed property owners to pay franchise fees on their gas and utility bills, at a public hearing before the Municipal Government Board in Black Diamond council chambers Sept. 18. Franchise fees are charged to Black Diamond property owners but not county residents.

The annexation proposal, approved by Black Diamond and Foothills County councils last spring, calls for refunding the franchise fees to annexed landowners for three years. The fees represent 16 per cent of the distribution portion of each property’s gas bill and 10 per cent of the distribution portion of the electric bills.

Ference learned the franchise fee could cost $1,200 annually for her 10-acre chicken operation southeast of Black Diamond.

“It’s another form of taxation,” she told the board. “Either grant the extension or take our property out of the annexation area.”

Ference suggested the fees be refunded for 25 years, the same timeframe the proposal states affected property owners will pay county-rated taxes to the Town until a triggering event like subdividing, redesignating land or connecting to town water and sewer services at the landowner’s request occurs.

Hocking, who farms south of Black Diamond with husband David, agrees that three years reprieve on the gas and power franchise fees is not adequate.

“I feel that it should be extended because we’re still farming,” she said, adding farmers pay hefty fees for power and gas. “It’s really basically the principle of it.”

Black Diamond planning and development officer Rod Ross said the three-year exemption allows time for residents to make financial adjustments in preparation for the impending expense.

“It’s more so than you see in other annexations in the province,” he told the board. “We felt that it was fair to give them something because it is a change and an increase in their fees.”

Ross said refunding the franchise fees is “quite a burden for the Town” in terms of administration time. Franchise fees are paid to the utility companies, which in turn reimburse the Towns. The proposal calls for the Town to issue cheques to five property owners if the proposal is accepted.

Foothills County director of planning Heather Hemingway told the board she considers refunding the franchise fees for three years as “very generous.”

She said no allowances were made in the recent annexation agreement with Okotoks and current negotiations with High River is exploring refunding franchise fees for a year.

As for removing Ference’s property from the annexation proposal, Hemingway said it’s not feasible.

“It would have a significant impact on annexation,” she said. “It would change the nature of the annexation.”

Ross told the board that removing the Ference property would be “unacceptable,” requiring the removal of the entire quarter section and impacting the transition of infrastructure to nearby proposed annexation lands.

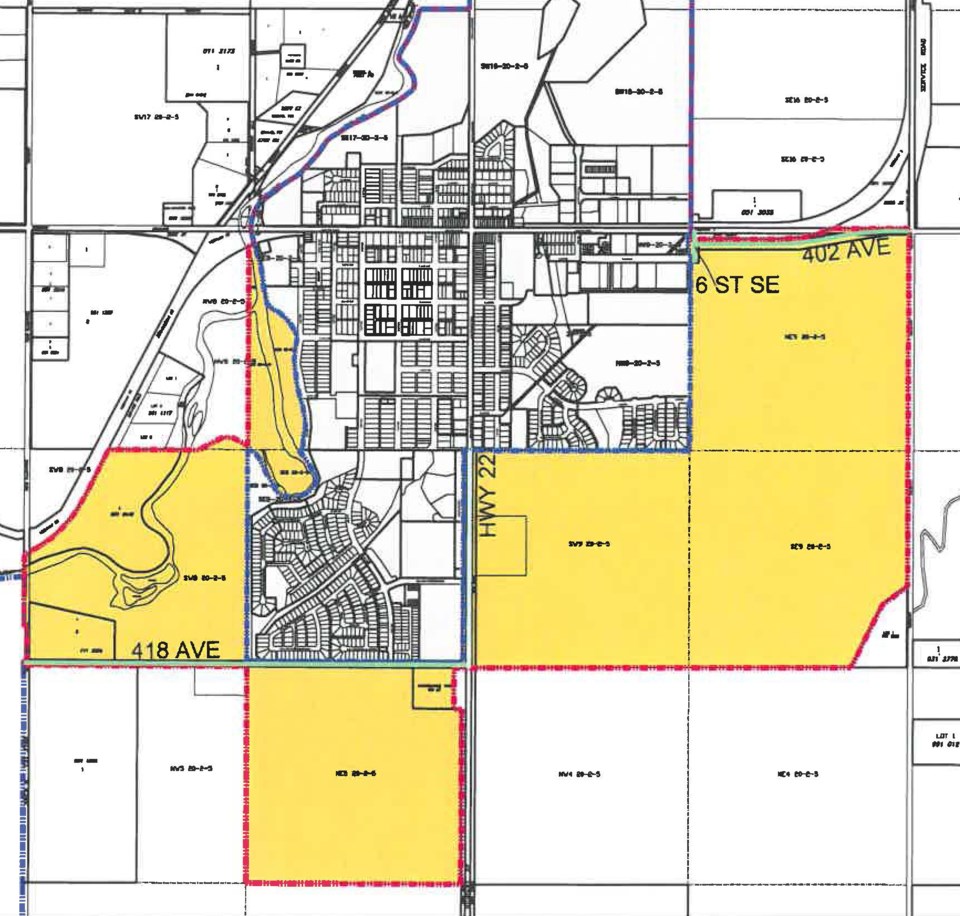

Black Diamond’s annexation proposal calls for annexing quarter sections of land east and south of town, as well as between Black Diamond and Turner Valley south of Highway 7 to create continuous borders between the towns in the event of amalgamation for five decades of growth.

Most of the land is for residential development, with industrial development proposed south of Highway 7 at Black Diamond’s east end and some commercial development on both sides of Highway 22 at the town’s south end.

If approved, the agreement stipulates that Black Diamond will pay Foothills County $110,770 in five equal annual payments, based on land values.

While Black Diamond administration submitted the proposal to Municipal Affairs for approval with plans for it to come into effect Jan. 1, 2020 to coincide with next year’s taxes, Municipal Government Board case manager Rick Duncan suggested the process could take several months and implied an effective date in the spring.

Duncan said the Municipal Government Board will deliberate using the information presented on Wednesday before presenting recommendations to the Minister of Municipal Affairs Kaycee Madu, who will take his decision to the Cabinet for final decision.

.JPG;w=120;h=80;mode=crop)