Foothills County residents will pay a bit more in taxes this year after councillors passed its 2019 budget on May 8.

“If your property is assessed at $815,000, based on the mill-rate increase, your taxes will go up $94,” said Christine Hummel, the county’s director of corporate services.

A ratepayer with property assessed at that value would have paid $4,975 in 2018, while now he or she will pay $5,069.

For non-residential, for a property assessed at $1.5 million, taxes are expected to increase $236 a year from $18,098 to $18,334 in 2019, which represents a 1.3 per cent increase in the non-residential mill-rate.

County councillors passed a balanced budget of $71.13 million at their May 8 meeting in High River. Last year’s budget came in at $73.48 million.

“The increase costs were mostly due to increased costs related to recreation, fire, enhanced RCMP policing, fuel costs and the road construction program,” Hummel said.

She said a stumbling block was the provincial budget had not been set due in part to the change of government.

“We did not have a school requisition for this year, so we have an estimate,” Hummel said. “That was the only hitch.

“There is an estimated increase on the school tax of 2.74 per cent based on the equalization increase of last year.”

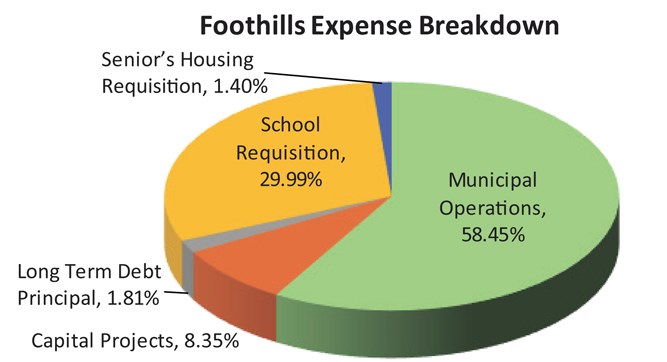

The school requisition of $21.3 million represents approximately 29 per cent of the County’s expenses.

An increase in the estimate for taxes for the school requisition was partially offset by a reduction in taxes for municipal purposes.

The carbon tax, which Premier Jason Kenney has vowed to eliminate, has been factored into the 2019 budget.